看一下终身人寿保险

以换取固定的保费, an insurance company promises to pay a set benefit when the policyholder dies, but also offers additional benefits as well. Whole life insurance policies can build up cash value — effectively a cash reserve that pays a modest rate of return, 而且这种增长是延税的. Guarantees are based on the claims-paying ability of the issuing company.

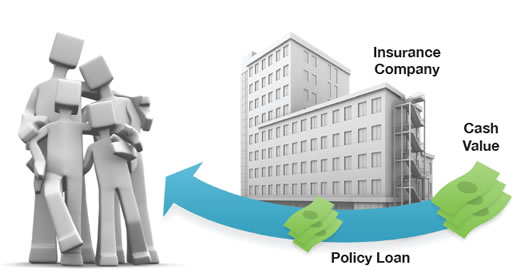

Most whole life insurance policies allow policyholders to borrow a portion of their policy’s cash value. Access to the cash value can allow you to pay for things like college expenses, 房屋首付款, or any other needs you may have. Interest payments on policy loans go directly back into the policy’s cash value.

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

Whether whole life insurance is the best choice for you may depend on a variety of factors, including your goals or circumstances.

When you borrow against this cash value of your policy, there are some important points to consider. Accessing the cash value of the insurance policy through borrowing — or partial surrenders — has the potential to reduce the policy’s cash value and benefit. Accessing the cash value may also increase the chance that the policy will lapse and may result in a tax liability if the policy terminates before your death.

As with all types of life insurance, several factors will affect the cost and availability of whole life insurance, 包括年龄, 健康, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder may also pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Life insurance is not insured by the FDIC (Federal Deposit 保险 Corporation). It is not insured by any federal government agency or bank or savings association.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by love爱博体育app下载 to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. 所表达的意见和 material provided are for general information, and should not be considered a solicitation for the purchase or 出售任何证券. 版权 love爱博体育app下载.